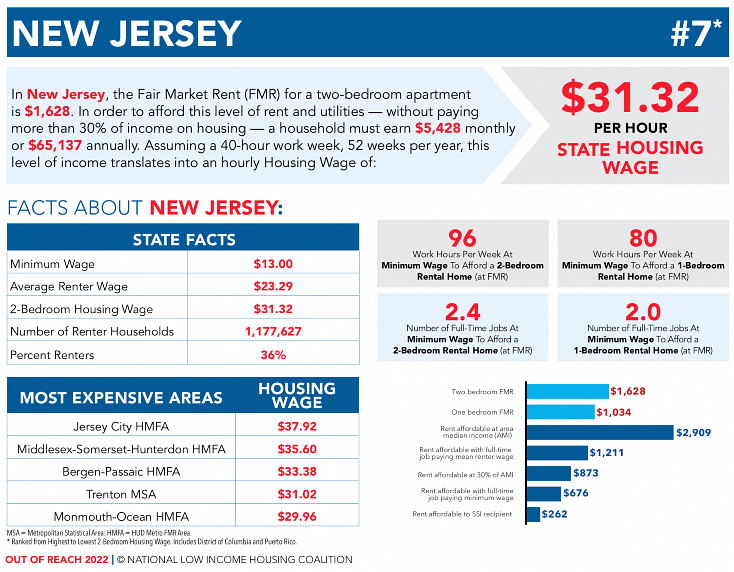

The annual survey produced by the Washington, D.C.-based National Low-Income Housing Coalition ranked the state seventh in unattainable housing costs.

By Matt Skoufalos | August 12, 2022

Nationally, locally, and statewide, housing costs remain stubbornly disconnected from earnings, as revealed in “Out of Reach,” the annual national survey of housing costs from the nonprofit National Low-Income Housing Coalition (NLIHC).

According to the NLIHC, the average Fair Market Rent (FMR) for a two-bedroom apartment in New Jersey is $1,628 per month.

To afford that rent plus utilities without dedicating more than 30 percent of income towards those costs, renters would have to earn $5,428 per month ($65,137 annually).

But many renters in New Jersey don’t command that earning power.

According to the results of the study, which are based on annual FMR calculations provided by the U.S. Department of Housing and Urban Development (HUD), nearly half a million (497,769) of the 1.17-million renter households in New Jersey earn less than 50 percent of the area median income (AMI) in their communities of residence.

More than a quarter-million (300,702) of those renter households earn less than 30 percent of AMI. And no one earning the state minimum wage of $13 per hour would be able to afford a modest, one-bedroom rental home at FMR ($1,344) working fewer than 80 hours per week.

Nationwide, New Jersey ranks seventh in unaffordable rental housing, falling just outside the uppermost echelon of a list topped by Hawaii, California, Massachusetts, New York, Washington, D.C., and Washington state, respectively. The full report surveys D.C. and the territory of Puerto Rico as well as all 50 U.S. states.

Moreover, NLICH Research Analyst Emma Foley said that the report likely under-estimates the prices of rent being paid across the country, as it’s based on data released in late 2021, which don’t completely capture the estimated 18 percent year-over-year rent increases that began in early 2021, and which have persisted since.

“For the most part, [the report] under-estimates the extreme increases in rental prices that we’ve seen,” Foley said. “Housing wages, while stark on their own, are likely under-estimates of what people moving right now need to make to find housing that is affordable to them.”

Even without real-time wage data, Foley said analysts know well that wages haven’t kept pace with rental costs for decades. With 2022 rents up by nearly one-fifth over year-ago levels, “it’s likely that many low-income workers will struggle even more than they struggled before the pandemic,” she said.

“We spoke with many low-income tenants who were cost-burdened before,” Foley said. “These rent increases mean they have to pay 80 percent of their wages towards housing.”

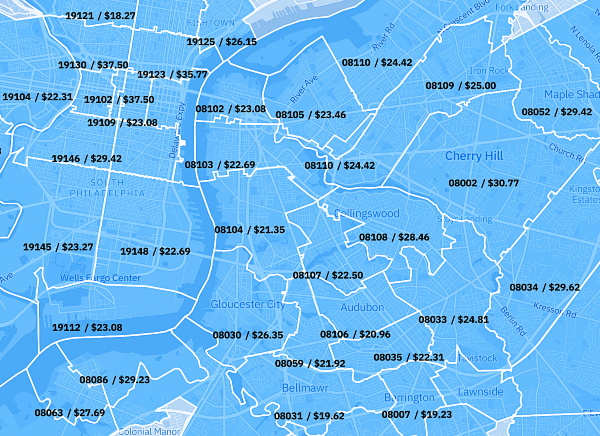

Camden County Zip Codes and the hourly wages necessary to afford living there without spending more than 30 percent of income on rent. Credit: 2022 NLIHC “Out of Reach” study.

In Camden County, household AMI is $105,400, which can comfortably cover a monthly rent of $2,635 without spending more than 30 percent of earnings on rent and utilities, according to the report. Of the total number of households in the county, an estimated 34 percent are renters (65,663).

The estimated hourly mean renter wage for 2022 in Camden County is $16.29, which would only cover $847 per month while spending 30 percent of income on rent and utilities. A two-bedroom apartment at FMR should cost just under $1,300 per month, according to the report, but that still means that a renter earning the mean amount in Camden County would need one-and-a-half 40-hour-work-weeks of wages to pay for it, or a job that pays nearly $10 per hour more.

For those earning less than these wages, the challenge of affording even a modest rental unit is significant. These economic realities often underlie what Foley described as “the more hidden phenomena of housing insecurity.” Beyond homelessness and housing evictions, many people “are doing things behind the scenes that aren’t observed as easily,” to stabilize housing, she said.

These could include including crashing on a friend’s couch long-term, taking on additional roommates to help make rents, picking up second or third jobs, or maybe even remaining in uncomfortable relationships simply to remain housed. Although NLIHC hasn’t systematically collected such data, Foley said she’s confident that increasing rents have driven additional homelessness, evictions, and “more precarious housing situations,” like overcrowding.

“In COVID, the biggest thing you could do to remain safe was isolate from others,” she said. “When you’re in close quarters to remain in housing, it puts you at a variety of health risks.”

Moreover, rents have been driven up further by a red-hot national housing market that has seen homebuyers paying cash premiums over asking prices and purchasing properties unseen amid scarce housing availability. Those who might otherwise have bought a home have remained in rental arrangements instead, further limiting the availability of such units for those who still need an affordable place to live.

“It further and further constrains the supply, constraining what low-income renters have access to,” Foley said.

Speculative property investment has also played a role in limiting housing availability and affordability, as investors buy up single- and multi-family properties, consolidating them in the hands of fewer landlords, who raise prices, defer maintenance, and tack on new tenant fees.

Although Foley said these circumstances are being more commonly discussed in Congress, any solutions to address housing as “in the preliminary stages.”

“Our CEO just testified in front of Congress on this topic, so I hope to see more protections put in place that would protect tenants from harmful activities from large landlords,” she said.

“I am hopeful that more people are paying attention now, and hopefully we’ll see some federal action to protect tenants,” Foley said.

So far, some cooling in the rental market has been observable, but that hasn’t yet equated to falling prices. The closest thing to encouragement for renters is that rents aren’t yet increasing as rapidly as they had been. Foley believes that low-income renters “will continue to struggle unless federally significant investments are made in housing.”

To that end, NLIHC has been lobbying for an expansion of funding for the National Housing Trust Fund, which could provide universal housing vouchers for qualifying tenants, she said. Currently, only about one in four renters who would qualify for housing assistance can obtain it because of funding and voucher limitations.

But this solution, like any other, will require concerted efforts at the federal level to address in any depth of significance.