Members of the Collingswood Democratic caucus and NJ Working Families accused the JIF executive board of giving the political player control of its $26M insurance fund through three separate companies.

By Matt Skoufalos | August 27, 2019

Sue Altman of NJ Working Families at the Camden County Municipal JIF Meeting, August 2019. Credit: Matt Skoufalos.

Camden County political power broker George Norcross has seldom been without his share of critics, but on Monday, a handful of them rallied at a niche government meetings—that of the Camden County Municipal Joint Insurance Fund (JIF)—to take a shot at his purse strings.

Historically one of the least-attended public meetings in local government, the JIF represents a pool of insurance money into which some 37 of its member municipalities contribute.

The fund, which was created some 30 years ago as a group purchasing organization to lower the cost of municipal insurance claims and administration, is managed by private corporations who are selected annually by an executive board of JIF members.

Conner Strong & Buckelew of Marlton, for which Norcross serves as executive chair, is the insurance brokerage for many towns that participate in the Camden County JIF, and others throughout the state. Its subsidiary, PERMA Risk Management Services, provides an executive director for the management of the fund. A second Conner Strong subsidiary, J.A. Montgomery Risk Control, provides loss control services for the JIF.

Together, those businesses generated more than $1 million in professional service fees from the Camden County JIF in 2018—and to some, those relationships are too close for comfort.

Sue Altman of the advocacy group New Jersey Working Families Alliance said the apparent absence of “an arm’s-length difference” among companies that are contracted by Camden County JIF is problematic.

With different branches of the same company servicing multiple aspects of the $26-million fund, those relationships aren’t “designed to produce the best and cheapest results for tax-paying residents,” Altman said.

“When it’s such close dealing, it’s a concern,” Altman said. “In a business where there’s no competition… no one person should have that much power.”

Collingswood Democratic Chair Kate Delaney echoed those concerns.

“We have a lot of concerns about the lack of transparency of the Camden County Municipal JIF,” Delaney said.

“It seems there’s lots of public money involved, and it’s operating below the public eye.

“We want more clarification of how this operates.”

Camden City community organizer Amir Khan asked the body to consider the impact of contracting with “George Norcross and his companies” while they are under investigation from the Murphy administration for their connections to client corporations that have benefitted from rich incentives through the state Economic Development Authority (EDA).

“When [Norcross] is deposed, anyone who is connected with him gets deposed as well,” Khan said. “I really, really reach to your conscience. You’re coming up in the next couple of months to vote on those new contracts. Do you honestly feel comfortable in your heart voting for an organization like Conner Strong, knowing that that organization is suing the governor?

“Tens of millions of dollars are being funneled through this one organization here in Camden County,” he said.

Collingswood Mayor Jim Maley, current secretary to the JIF executive board, challenged Khan’s remarks as an “inappropriate” inference of wrongdoing. Some of those criticisms owe to consolidation in the insurance market (the JIF had prior contracts with PERMA and J.A. Montgomery before they were acquired by Conner Strong, Maley said); others can be explained by a lack of available competition for the business.

“None [of the businesses] has cross-responsibilities, and none of them supervises the other,” Maley said. “They contract with us; every town gets their own insurance broker. We don’t buy insurance from them.”

Although the JIF bids out contracts annually, the organization seldom receives interest in its business from companies other than those with whom it has historically worked, he said.

“These JIFs are saving a fortune, and part of that is securing the coverage,” Maley said. “I get how people feel it doesn’t look right, but we go out on RFP’s every year. I don’t know that we’ve had other responses, if any.”

Asked about the $1 million worth of business the Camden County JIF has generated for Conner Strong and its affiliates in the past year, Maley pointed to the money the communities involved are saving from the group purchasing arrangement and management of their insurance needs.

Participating communities receive dividends from the management of the JIF, which they either recoup in the form of a cash payment, or parlay into the cost of premiums for the next year, he said.

“We do not contract with Conner Strong to buy insurance,” Maley said.

“We have professionals that either find insurance on the open public market that we buy together, not from George Norcross companies.

“We self-insure ourselves up to certain levels of coverage that we control,” he said. “Towns are able to hire their insurance broker; some towns have hired Conner Strong, and some towns have not.

“This is a self-insurance pool,” Maley said. “This group controls the money that is paid in. We assess towns, we set up the budgets to run insurance, and it has been run for 25 years because it has generated millions of dollars in savings when compared with commercial insurance.”

Brooklawn Councilman Michael Mevoli, who chairs the JIF executive committee, said that since the fund grew from a 10-town consortium in 1987 to a 37-municipality group some 30 years later, its purchasing power has saved communities much more money than they would have otherwise seen.

“[In a JIF structure], we are the insurance company,” Mevoli said. “A profit in anything an insurance company makes, you would never see. We, the towns, benefit from that dividend every single year to lower your taxes.”

Before the organization was incorporated, municipalities that had purchased insurance rates individually on the open market had been subject to mid-year rate increases that threw off their annual budgets, Mevoli said.

“How would you come up with a 15-20-percent increase in the middle of the year?” he said. “It was very difficult to do that.”

Haddonfield Mayor Neal Rochford, who also sits on the JIF executive board, said that his borough “looked outside of the JIF” to rate-shop, “and quite frankly, many of the companies said, ‘We can’t touch the rates you’re getting from your self-insurance.’

“I know that over the years, we’ve saved millions and millions of dollars,” Rochford said. “Other private insurer groups would not do that at all.”

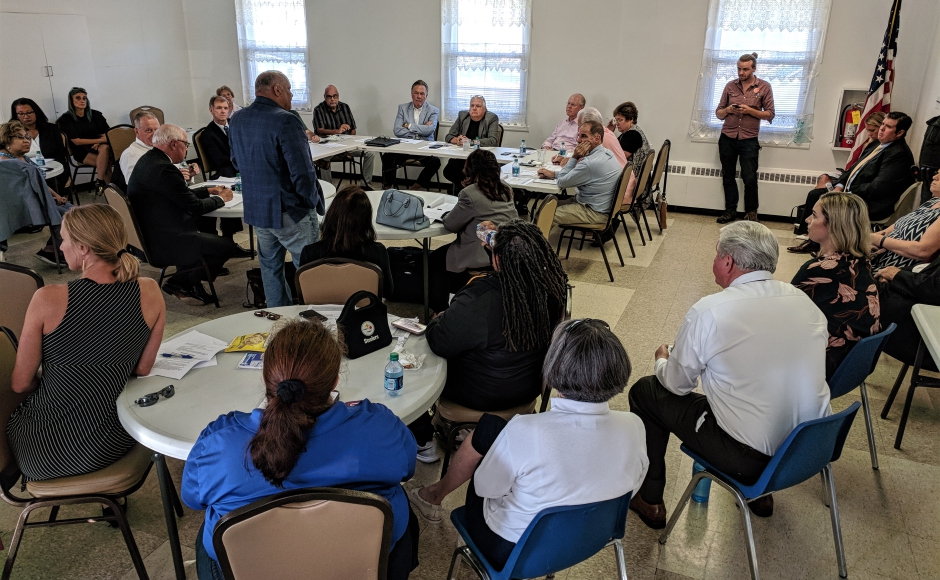

Members of the Camden County Municipal JIF engage with the public at the August 2019 meeting of the body. Credit: Matt Skoufalos.

Mount Ephraim Mayor Joseph Wolk pointed out that the JIF is “closely regulated by the New Jersey Department of Banking and Insurance.”

Other members of the JIF executive board pointed to various mechanisms designed to identify conflicts of interest, including ethics self-disclosures, and external auditing by Bowman & Company, which also provides or has provided auditing services for numerous other JIFs throughout the state.

But neither the reported financial efficiency of the JIF nor its controls for hedging against conflicts of interest satisfied Delaney, who claimed that the companies involved share relationships that are “troubling” politically.

“The firms that have the contracts are the most generous [campaign] donors,” she said, without providing specific details. “[These are] relationships that seem too cozy.”

Conner Strong & Buckelew spokesperson Daniel Fee summed up Altman’s, Delaney’s, and Khan’s remarks as “false and misleading claims” by “professional activists” that amounted to politically motivated, personal attacks on Norcross.

PERMA and J.A. Montgomery are subsidiaries of Conner Strong, but Fee said they’re horizontally, not vertically integrated. The JIF appoints each business individually, not because one vendor demands it, he said.

“[Claiming violation of an] arm’s-length transaction somehow means that PERMA is involved in the award of these contracts,” Fee said. “That’s factually false.

“Conner Strong doesn’t pick vendors, the JIFs do,” he said. “[Conner Strong & Buckelew] bought PERMA because it was a successful firm. That’s why they bought J.A. Montgomery, too.

Fee added that oversight of JIF processes is given over to five separate state agencies, including the Department of Community Affairs, Department of Labor and Workforce Development, Department of Environmental Protection, Department of Banking and Insurance, and the state controller.

He cited that oversight as part of the transparency required by law for the administration of the JIF, and claimed that the entity is fulfilling its obligation to disclose such information as required by law.

“It’s public money, and it should be transparent,” Fee said. “There should be as much disclosure and transparency as possible. But when [critics] go to a public meeting and say that they OPRA’d a bunch of documents… what other transparency would they like?”

NJ Pen is free thanks to regular, small contributions. Please support our work.

| Subscription Options |